共赢

未来

WIN WIN FUTURE

产业类

INDUSTRY CATEGORY

加大对实体产业跨境融资的支持力度

Increase the Strength of Support for Cross-Border Financing of Physical Industries

-

●通过推广发行狮城债、跨境商业贷款、跨境融资租赁等多样化的跨境融资模式,为产业发展拓宽融资规模,满足多元化金融需求。

Through adopting diversified cross-border financing modes such as promoting and issuing Lion City Bond, cross-border commercial loans, and cross-border financial leasing, expand the financing scale for industrial development and meet diversified financial demands.

-

●鼓励贸易金融风控模型创新,推广运用贸易融资工具,为企业“走出去”和开展对外贸易提供风险保障和融资便利服务,实现市场扩容和风险可控兼备。

Encourage innovation in trade and financial risk control models, promote the use of trade financing tools, and provide risk protection and financing facilitation services for enterprises when "going global" and carrying out foreign trade, so as to achieve market enlargement and risk management.

支持实体产业科技升级

Support the Technological Upgrade of Physical Industry

-

• 通过发展创业投资基金、支持创新型企业赴新上市、推进知识产权证券化等方式,加大对初创型和成长型科技企业融资支持力度,利用国内国际金融市场优势支持创新型中小企业成长为创新重要发源地。

Through developing venture capital funds, support innovation-based enterprises to go public in Singapore, promoting the securitization of intellectual property and other methods, increase the strength of financing support for start-up and growing technology enterprises, and utilize the advantages of domestic and international financial markets to support innovation-based SMEs to grow into significant cradles of innovation.

-

• 支持以促进产业结构升级、技术进步为目的的跨境并购,加快人民币海外投贷基金应用,鼓励高技术企业“走出去”参与产业技术创新研发,利用国际金融市场,积淀产业技术创新研发资本。

Support cross-border mergers and acquisitions with a view to promote industrial structure upgrading and technological progress, accelerate the application of RMB overseas investment and loan funds, encourage high-tech enterprises to "go global" and participate in the innovation, research and development of industrial technologies, use the international financial market, and accumulate capital for the innovation, research and development of industrial technologies.

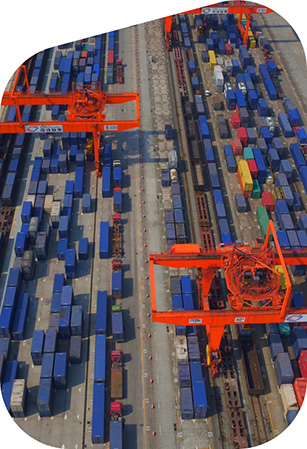

提升金融服务陆海新通道水平

Improve the Level of New Land-Sea Corridor for Financial Services

-

●开展对“一带一路”沿线国家和地区的对外直接投资,支持“陆海新通道”等重点项目建设,在“走出去”中推进“一带一路”协同发展。

Carry out foreign direct investment in countries and regions along the “Belt and Road”, support the construction of the “New Land-Sea Corridor” and other key projects, and promote the coordinated development of the “Belt and Road” in the “going global” process.

-

●积极打造“陆海新通道”物流金融服务创新平台,为实体产业搭建中新金融资源集聚平台,加速物流和资金流的高速运转,推进物流金融业务向规范化、国际化迈进。

Actively build the logistics financial service innovation platform for the "New Land-Sea Corridor," set up the China-Singapore financial resource gathering platform for the physical industry, accelerate the high-speed operation of logistics and capital flow, and push forward the standardization and internationalization of logistics financial business.

-

●探索联合授信、同业融资、在银行间市场发行主题债券等方式,增强金融供给能力,提升金融服务质效,多渠道保障陆海新通道沿线资金需求,做深做实对接“一带一路”的中新互联互通陆海新通道。

Explore the adoption of methods such as joint credit granting, inter-bank financing, and the issuance of thematic bonds in the inter-bank market, to enhance financial supply capabilities, improve the quality and efficiency of financial services, and ensure satisfaction of funding demands along the New Land-Sea Corridor through multiple channels, thus deepening and consolidating the New Land-Sea Corridor under the China-Singapore Connectivity Initiative that docks with the “Belt and Road”.